CBN Withdraws Directive To Banks On Cybersecurity Levy Implementation

The Central Bank of Nigeria (CBN) has withdrawn its earlier directive mandating a 0.5% cybersecurity levy on electronic transactions.

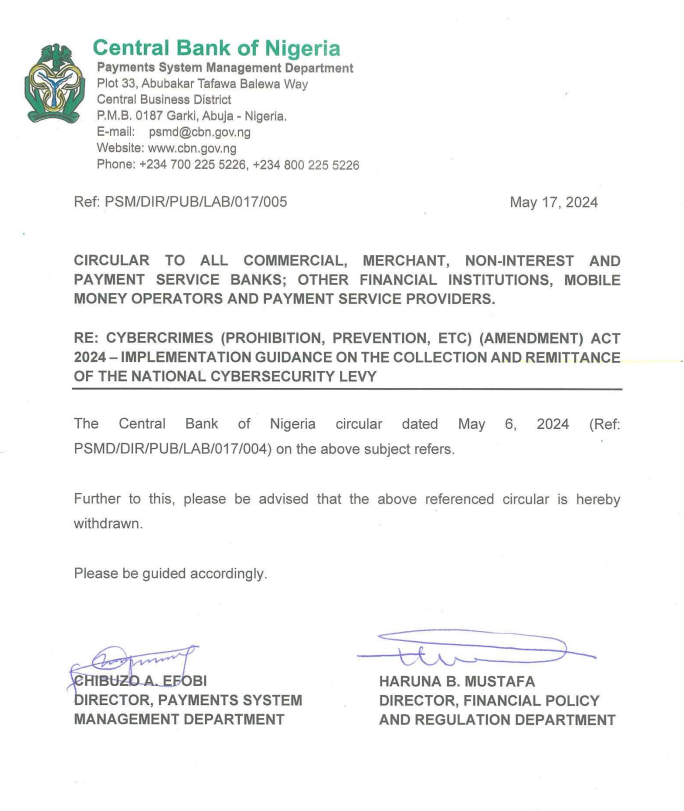

This was contained in a circular issued to all commercial, merchant, non-interest and payments service banks; other financial institutions, mobile money operators and payment service providers, jointly signed by the Director, Payment System Management Department, Chibuzo Efobi and the Director, Financial Policy and regulations department, Haruna Mustapha.

The action could be attributed to widespread public condemnations and a subsequent suspension of the levy by the President, Bola Ahmed Tinubu.

The initial directive, issued in a circular on May 6, 2024, instructed deposit money banks, mobile money operators, and payment service providers to deduct the levy and remit it to the National Cybersecurity Fund (NCF). The NCF is managed by the Office of the National Security Adviser (ONSA).

The announcement of this policy led to public outcry, with labour unions threatening actions and various pressure groups criticizing the timing, given the current cost of living crisis and rising inflation.

In light of the controversy, Information Minister Mohammed Idris announced on May 14, 2024, that the Federal Government had decided to suspend the levy.

Following this, the CBN issued a new circular on May 17, 2024, officially withdrawing the previous directive. The latest circular, signed by Chibuzo Efobi, Director of Payments System Management Department, and Haruna Mustafa, Director of Financial Policy and Regulation Department, instructed all financial institutions to disregard the earlier instructions on the cybersecurity levy.

This retraction marks a significant response by the CBN to the concerns raised by the public and stakeholders within the financial sector.