The National Insurance Commission, NAICOM said the current foreign exchange challenge and the inflationary trend have impacted adversely on the insurance sector just like in other sectors of the economy.

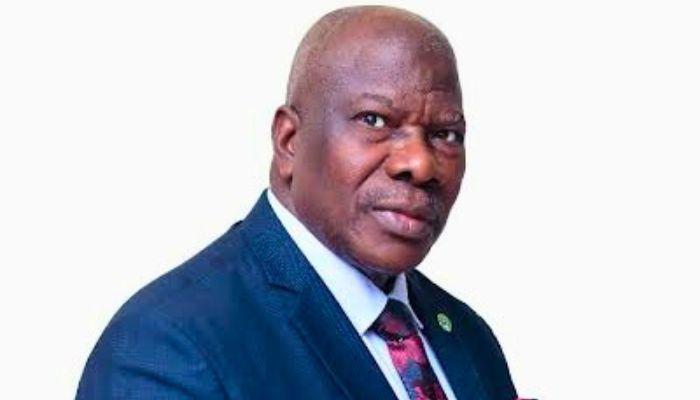

Commissioner for Insurance, NAICOM, Sunday Thomas, who disclosed this at a pre-retreat interactive session with newsmen in Uyo the Akwa Ibom State capital said with the various initiatives of the Tinubu led administration, the negative impacts will elapse soon.

He said under the present circumstance, Nigerians need to adjust the value of their assets in order to derive maximum benefits as increased value means more premium to pay.

“When we have this less level of exchange rate, assets replacement becomes an issue, and when you get to the position where assets that were acquired at a particular amount, especially assets that are foreign exchange dependent, people are not quick to revalue there assets,” he said.

He noted that where there is inflation such as the present situation, life insurance is worst affected.

“Of course, the fact is that where there is inflation, life insurance is worst hit because the value of your claim will be badly affected.

“But you see what we are going through as nation, I believe that it is temporary.

“Two things had happened, the issue of subsidy removal and the issue of consolidation of the exchange rate.

“All these are at the point of policy change and there are bound to be push back.

“So, what we are experiencing now are all push back, push back is bound to affect every sector of the economy.

“But if you look at what is happening now, the exchange rate is adjusting itself downwards.

“However, there are things still being done and by the time, the entire initiatives materialises, definitely it will fine its level,” he added.